Airtel Africa has demonstrated robust operational and financial momentum for the year ended 31 March 2025, supported by strong customer growth, rising data usage, and expanding mobile money services.

Customer Growth Driven by Digital Inclusion

Airtel Africa’s total customer base increased by 8.7% year-on-year, reaching 166.1 million subscribers. The company’s efforts to boost digital inclusion led to a 4.3% rise in smartphone penetration to 44.8%, with the number of data customers growing 14.1% to 73.4 million. Average data usage per customer surged by 30.4% to 7.0 GB, driving a 15.4% increase in data average revenue per user (ARPU) in constant currency.

In the mobile money segment, subscriber numbers rose by 17.3% to 44.6 million. Airtel Africa attributed this growth to continuous investment in agent networks and enhanced digital offerings. In Q4 FY2025 alone, transaction value rose 34% in constant currency, resulting in an annualised transaction volume of $145 billion.

Network Expansion Supports Customer Experience

To strengthen its network infrastructure and improve customer experience, Airtel rolled out 2,583 new sites and laid approximately 3,300 kilometres of fibre across the region. These efforts significantly enhanced data capacity, supporting the rising demand for digital services.

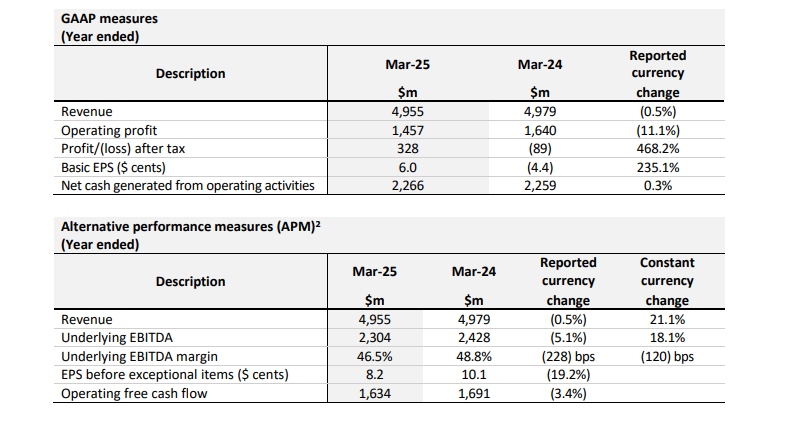

Strong Financial Performance Amid Currency Challenges

Despite a reported revenue decline of 0.5% due to currency devaluation, Airtel Africa’s revenue grew by 21.1% in constant currency to $4.96 billion. Q4 FY2025 marked the peak of this growth momentum, with revenue rising 23.2% in constant currency and 17.8% in reported currency as currency headwinds began to ease.

Mobile services revenue grew by 19.6% in constant currency, driven by a 10.6% rise in voice revenue and a 30.5% increase in data revenue. Mobile money revenue rose by 29.9% in constant currency.

Underlying EBITDA for the year declined by 5.1% in reported currency to $2.3 billion, impacted by higher fuel prices and lower contributions from Nigeria. However, quarterly EBITDA margins improved from 45.3% in Q1 to 47.3% in Q4, supported by cost optimisation measures and a more stable operating environment.

Profit after tax reached $328 million, a significant turnaround from the $89 million loss in the prior year, which had been heavily affected by foreign exchange and derivative losses. Basic earnings per share (EPS) improved to 6.0 cents from a negative 4.4 cents, while EPS before exceptional items dropped from 10.1 cents to 8.2 cents due to higher finance costs related to tower contract renewals.

Capital Allocation and Debt Management

Capital expenditure for the year stood at $670 million, below guidance due to deferred data centre investments. Airtel expects to invest between $725 million and $750 million in FY2026 to support future growth. The company also reduced its foreign currency debt by $702 million, increasing the proportion of local currency debt to 93%.

However, total leverage increased from 1.4x to 2.3x, largely due to a $1.3 billion rise in lease liabilities from tower contract renewals. Lease-adjusted leverage rose from 0.7x to 1.0x, reflecting the effects of currency devaluation and a lower lease-adjusted EBITDA.

A final dividend of 3.9 cents per share was declared, bringing the total annual dividend to 6.5 cents—a 9.2% increase from the previous year. The company also returned $120 million to shareholders through share buybacks.

CEO Outlook and IPO Preparations

Commenting on the results, Airtel Africa CEO Sunil Taldar said, “We have reported another strong operating performance as our strategy continues to deliver against the significant opportunity that exists across our markets. Our focus on digital and financial inclusion continues to drive growth in smartphone and mobile money usage.”

He added that preparations for the Airtel Money IPO are progressing well, with a potential listing event expected in the first half of 2026, subject to market conditions.

Despite global uncertainties, Airtel Africa remains optimistic. “Our strong capital structure, expanding network, and improving margins put us in a solid position to continue delivering growth while transforming lives and supporting economic prosperity across our markets,” said Taldar.