By our special Corrspondent

Iringa, Tanzania

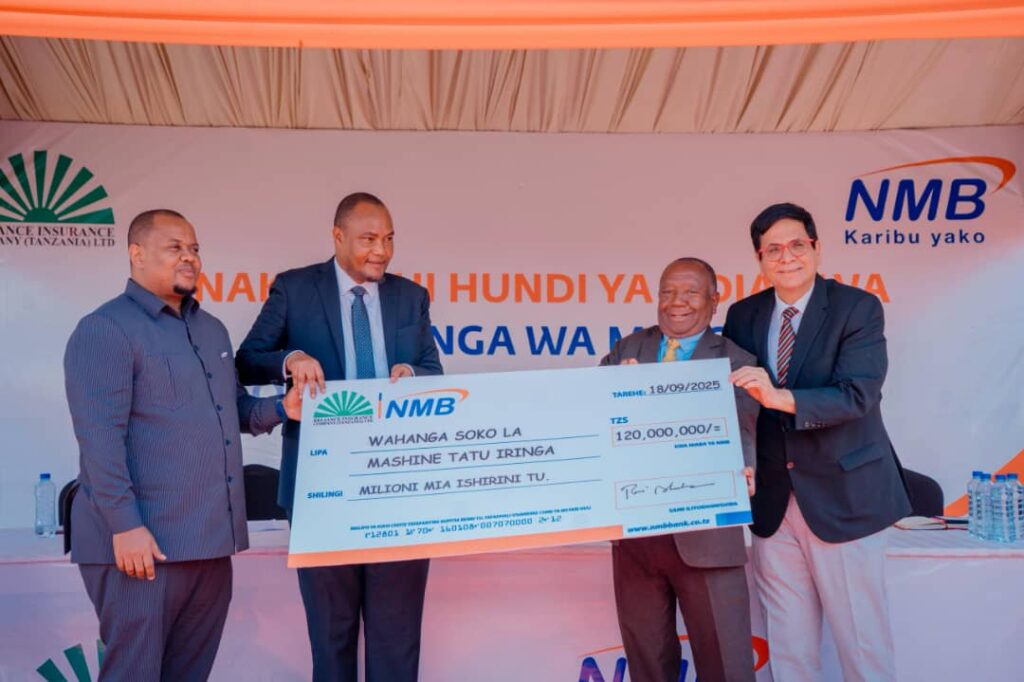

In a show of swift post-disaster relief and an example of effective insurance operations, NMB Bank and Reliance Insurance Company on Thursday presented a ceremonial cheque of TZS 120,000,000 to the representatives of traders affected by the July fire at Mashine Tatu market in Iringa Region.

The handover, held at Mlandege Market where displaced traders are currently operating, was witnessed by Dr. Baghayo Saqware, Commissioner of the Tanzania Insurance Regulatory Authority (TIRA), regional officials and local market leaders.

The payout benefits 40 traders who had outstanding loans with NMB Bank that were covered through the bank’s bancassurance arrangement with Reliance Insurance. Funds that will enable the small-scale businesses to restock, repair stalls and resume trade after the devastating blaze.

Speaking durig the event, Commissioner of the Tanzania Insurance Regulatory (TIRA), Dr. Baghayo Saqware acknowledged both NMB Bank and Reliance Insurance for the prompt fund payments and the act of the institution visiting the victims immediately after the incident to gather the required informations for refund processing.

“This timely intervention demonstrates how bancassurance can turn a potentially ruinous event into a manageable setback,” Dr. Saqware said during the ceremony.

“I congratulate NMB Bank and Reliance Insurance for the prompt action after the incident, ensuring victims are paid early and able to return to business. Although evaluation and claims processes can be demanding, both institutions worked tirelessly to meet the needs of the affected traders.”

“TIRA will continue to promote awareness and regulatory frameworks that encourage greater penetration of insurance products, especially among small businesses that are most vulnerable to shocks,” Dr. Saqware said.

The insurance commissioner also urged traders who are currently uninsured to explore affordable options, including the bancassurance packages that have now benefited the Mashine Tatu group.

The symbolic handover of the large cheque to the market chairperson was accompanied by expressions of relief and optimism among the beneficiaries.

Soeakinf during the event, chairperson of Iringa Municipality markets, Raphael Ngulo thanked both institutions for the rapid response since the incidence and how they have been close to them throughout the evaluation time and till the day they are receiving the refunds.

“On behalf of the victims, we thank the bank and the insurance company for their prompt action in paying back our losses. We will forever be ambassadors of insurance to our fellow market traders,” Mzee Rapahel said.

On the side of Reliance Insurance company, Ravi Shankar the Managing Director while speaking emphasized on their customer-centric approach and working under TIRA quick response on incidents instruction to ensure insurance customers quickly get back on the wheels.

He also thanked NMB Bank, market administrators and Iringa regional government officials to expedite assessments and disbursements.

“We appreciate the victims’ good cooperation during the evaluation process following the incident. Now they are receiving their paybacks,” Mr. Shankar said,

“Reliance Insurance’s commitment is to always support our clients and pay them in time whenever they encounter incidents like the Mashine Tatu market fire,” he added.

“For the affected traders, the refund represents a crucial lifeline. Beneficiaries will use the money to build stalls at Mlandege market and also portions of the funds to purchase essential stock and materials to reopen,” Ravi Said.

Speaking on behalf of NMB Bank, NMB Bank’s Head of Bancassurance, Martine Massawe, highlighted the advantages of integrating insurance with credit products to protect entrepreneurs. He also urged other small business owners to consider similar cover as a practical risk-management tool.

“Insurance is the simplest way to recover from incidents like fire, accidents or theft,” Massawe said. “NMB’s presence in almost every district in the country gives us the strength to support everyone to acquire insurance even in places without insurance company offices.” he Added

Massawe also said that the settlement followed thorough claims verification, inspections and documentation required under insurance protocols.

The speed of the payouts they noted was made possible by cooperation between the bank, insurer, regional authorities and market leaders who facilitated access to evidence and coordinated evaluations on the ground.

The Mashine Tatu blaze, which swept through a densely packed section of the market in late July, left dozens of traders with destroyed stock and damaged premises.

While recovery and reconstruction plans are still going on, the settlement underscores the role of insurance in economic resilience for micro and small enterprises; a priority that TIRA and market stakeholders say must be accelerated across the country.