NMB Bank has introduced an ambitious financial literacy initiative called ‘Nondo za Pesa,’ aiming to empower its customers and the broader community with essential financial knowledge and skills to help them make informed decisions for achieving their financial goals.

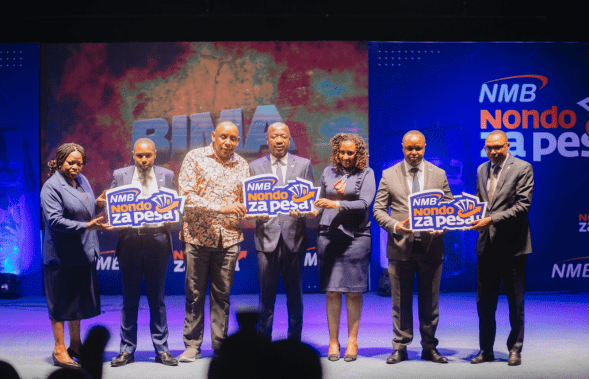

The program, launched yesterday in Dar es Salaam, will focus on fostering customer engagement and promoting meaningful financial well-being within communities. Through ‘Nondo za Pesa,’ NMB Bank seeks to guide individuals in effective money management, budgeting, and avoiding common financial pitfalls such as debt traps.

NMB Bank’s Chief of Retail Banking, Filbert Mponzi, highlighted the importance of financial literacy as the foundation for financial independence and inclusion. “In an era where financial decisions shape our lives, financial literacy is not just a desirable skill—it is a necessity,” Mponzi said.

The ‘Nondo za Pesa’ program will target individuals, particularly young people and women, with practical advice on daily expense management, budgeting, saving, and investment. Mponzi emphasized that the bank is committed to promoting financial education as a core part of its mission to create a more secure and prosperous future for all Tanzanians.

NMB Bank plans to extend this literacy drive through partnerships with both traditional and digital platforms to reach grassroots communities. The program will include workshops, resources, and educational sessions covering topics like goal-setting, savings, loans, creating investment portfolios, accessing markets, and risk management.

Citing the 2023 Finscope Survey, which showed low uptake of financial services among youths and women, Mponzi noted that ‘Nondo za Pesa’ aims to bridge this gap and contribute to financial inclusion, economic growth, and stability.

Additionally, NMB Bank offers products tailored for young people and women, such as the NMB Pesa account, which includes the ‘Mshiko Fasta’ feature for instant loans up to 1 million Tanzanian Shillings without requiring a branch visit.

Media personalities and stakeholders attending the launch praised the initiative, including prominent media figure Maulid Kitenge, who said, “This program has come at an ideal time and provides youths with a platform to access strategic financial information.”

Through ‘Nondo za Pesa,’ NMB Bank reinforces its commitment to empowering Tanzanians with the skills needed for sustainable financial success.